Charting New Horizons: Expanding Your Wealth Monitoring Portfolio With Offshore Trust Fund Providers

The Advantages of Offshore Depend On Solutions in Wide Range Administration

You'll be astonished at the advantages of overseas trust solutions in wide range monitoring. Offshore depend on solutions provide a broad range of advantages that can substantially boost your wide range administration portfolio.

Secondly, offshore trust fund services use boosted discretion. Unlike traditional onshore depends on, offshore trusts give a higher level of privacy and discretion. This can be especially valuable for people that value their economic personal privacy and dream to maintain their properties away from prying eyes.

Additionally, overseas trust funds supply tax obligation benefits. Several overseas territories offer beneficial tax obligation regimens, allowing individuals to lawfully decrease their tax obligation liabilities. By making use of overseas trust fund solutions, you can reduce your tax responsibilities and keep a larger portion of your wide range.

In addition, offshore trust funds allow global diversity. By purchasing international markets and holding assets in various territories, you can spread your danger and potentially boost your financial investment returns. This diversification method can aid you attain long-term financial development and stability.

Secret Considerations for Incorporating Offshore Depends On Into Your Profile

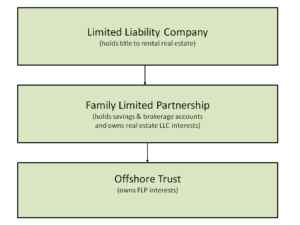

When integrating overseas trusts into your investment technique, it is necessary to think about vital elements. Offshore trust funds can supply numerous advantages, such as asset protection, tax benefits, and personal privacy. Nevertheless, prior to diving right into this kind of financial investment, you need to very carefully assess your goals and objectives.

Firstly, it's important to pick the right territory for your overseas count on. Different countries have various legislations and policies, so you need to locate a jurisdiction that lines up with your certain needs. You ought to consider aspects such as political stability, lawful structure, and online reputation.

Secondly, you should extensively research study and pick a reliable trustee to handle your overseas trust fund. The trustee plays a crucial duty in safeguarding and providing your possessions. Try to find a trustee with a strong track record, expertise in overseas trust fund management, and solid monetary stability.

Additionally, you should recognize the reporting needs and tax obligation implications connected with overseas counts on. It's necessary to abide by all relevant regulations and regulations to stay clear of any type of lawful concerns or fines in your home country.

Lastly, it's necessary to on a regular basis assess and check your offshore depend on to ensure it stays lined up with your investment goals. Economic and political modifications can affect the performance of your depend on, so staying notified and aggressive is critical.

Exploring International Jurisdictions for Offshore Count On Providers

Choosing the appropriate territory is essential when checking out global options for offshore depends on. With so many nations providing overseas count on services, it is important to consider various elements prior to making a choice.

One more important consideration is the tax obligation benefits supplied by the jurisdiction. Different countries have various tax obligation regulations and laws, and some might offer much more beneficial tax prices or exemptions for offshore depends on. By very carefully evaluating the tax obligation implications of each territory, you can optimize your wide range and reduce your tax obligations.

Ultimately, think about the convenience of doing organization in the jurisdiction. Search for countries with strong economic infrastructure, reliable governing structures, and a helpful service environment.

Optimizing Tax Obligation Effectiveness With Offshore Trust Structures

Maximizing tax effectiveness can be achieved with offshore trust structures that provide desirable tax rates and exceptions. By establishing an offshore trust fund, you can purposefully handle your wide range and lower your tax liabilities. Offshore jurisdictions frequently give eye-catching tax obligation incentives, such as lower or zero tax prices on income, funding gains, and inheritance. This enables you to keep more of your wide range read review and potentially grow it further.

Among the essential benefits of offshore trust funds is the ability to defer tax obligations. By putting your possessions in a count on, you can delay the settlement of taxes up until a later date and even avoid them entirely in some cases. This can be specifically valuable for individuals with significant financial investment earnings or those that anticipate future tax obligation increases.

Furthermore, offshore depends on supply a level of personal privacy and asset defense that you may not locate in your house territory. By putting your possessions in an offshore depend on, you can protect them from lawful disputes and possible financial institutions. This can offer peace of mind and protect your wealth for future generations.

It is very important to keep in mind that while overseas trusts provide tax obligation benefits, it is crucial to adhere to all suitable tax obligation laws and regulations. offshore trust services. Dealing with knowledgeable experts that focus on overseas trust structures can make sure that you make the most of tax obligation efficiency while continuing to be completely certified with the regulation

Mitigating Danger and Enhancing Property Defense With Offshore Depends On

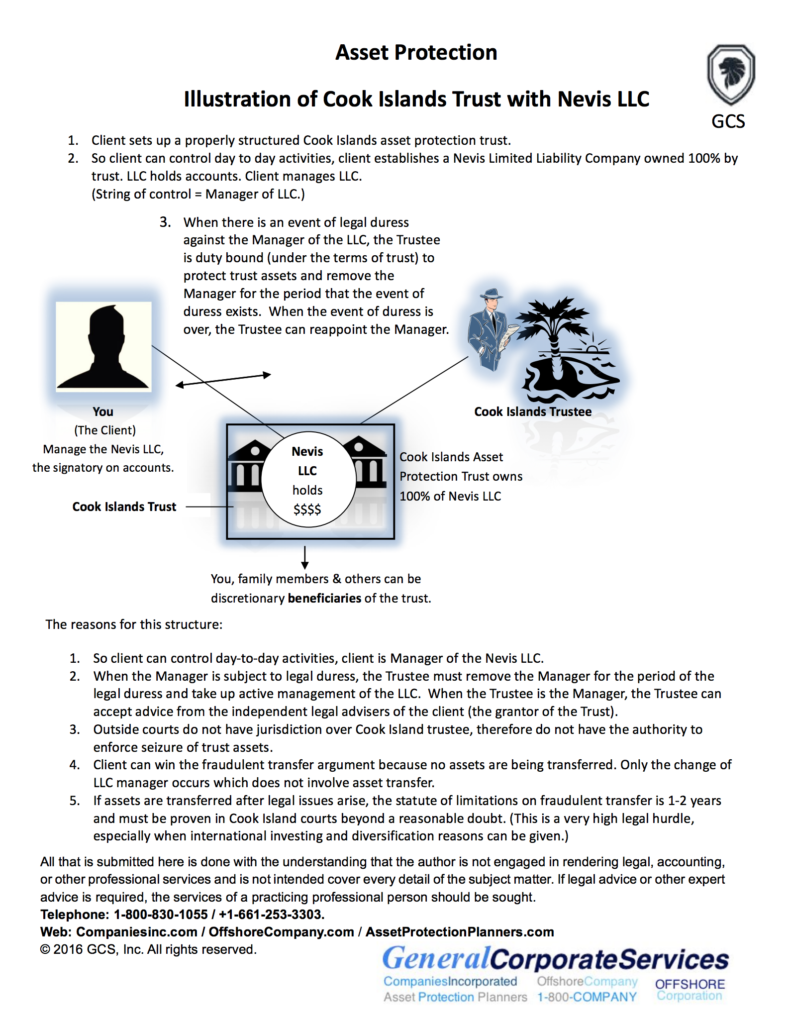

To alleviate threat and boost possession security, you can count on overseas counts on, which offer a degree of privacy and legal defense that might not be offered in your house territory. Offshore counts on supply a calculated remedy for protecting your riches by putting your assets in a different lawful entity beyond your home country. By doing so, you can secure your more tips here assets from potential lenders, legal actions, and various other threats.

Among the main advantages of making use of overseas depends on is the degree of personal privacy they afford. Unlike in your home territory, where your economic info may be conveniently accessed by government authorities or various other interested parties, offshore trusts provide a greater level of privacy. Your personal and financial information are kept personal, permitting you to keep a greater degree of control over your properties.

Moreover, offshore depends on can offer boosted property protection. In case of lawsuits or financial difficulties, having your properties in an offshore trust fund can make it more difficult for lenders to reach them. The depend on works as an obstacle, supplying an included layer of protection and making it harder for anyone seeking to seize your properties.

In enhancement to privacy and asset defense, offshore depends on can likewise offer tax advantages, which better contribute to your overall threat reduction technique. By meticulously structuring your trust, you can potentially decrease your tax obligations and optimize your estate preparation.

Final Thought

To conclude, by incorporating offshore depend on services right into your wealth administration profile, you can appreciate numerous advantages such as tax performance, property security, and accessibility to international territories. It is essential to thoroughly take into consideration vital variables when picking overseas trust funds, such as online reputation, governing framework, and professional proficiency. With appropriate preparation and assistance, you can expand your investment perspectives and this page safeguard your riches in a globalized globe. Do not lose out on the opportunities that offshore trust fund solutions can provide to expand and shield your riches.

Unlike standard onshore depends on, offshore trust funds give a higher level of privacy and discretion. Offshore trust funds can supply numerous benefits, such as possession protection, tax advantages, and personal privacy. Various countries have different tax obligation regulations and guidelines, and some may offer more beneficial tax prices or exemptions for overseas trust funds.Making the most of tax performance can be accomplished through offshore depend on structures that supply beneficial tax prices and exceptions.In verdict, by incorporating overseas trust fund services right into your wealth management profile, you can delight in many advantages such as tax obligation effectiveness, possession defense, and access to global territories.